BSE SENSEX

| |

| Foundation | 1 January 1986 |

|---|---|

| Operator | Asia Index |

| Exchanges | BSE |

| Trading symbol | ^BSESN |

| Constituents | 30 |

| Type | Large cap |

| Market cap |

|

| Weighting method | Free-float market capitalisation |

| Related indices |

|

| Website | official website |

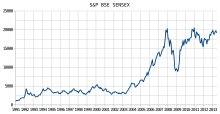

The BSE SENSEX (also known as the S&P Bombay Stock Exchange Sensitive Index or simply SENSEX) is a free-float market-weighted stock market index of 30 well-established and financially sound companies listed on the Bombay Stock Exchange. The 30 constituent companies which are some of the largest and most actively traded stocks, are representative of various industrial sectors of the Indian economy. Published since 1 January 1986, the S&P BSE SENSEX is regarded as the pulse of the domestic stock markets in India.[2][3] The base value of the SENSEX was taken as 100 on 1 April 1979 and its base year as 1978–79. On 25 July 2001 BSE launched DOLLEX-, a dollar-linked version of the SENSEX.[4]

Etymology

[edit]The term Sensex was coined by Deepak Mohoni, a stock market analyst in 1989.[5][6] BSE Sensitive Index then was at about 750 points. Sensex is a portmanteau of the words Sensitive and Index.

Calculation

[edit]The BSE has some reviews and modifies its composition to be sure it reflects current market conditions. The index is calculated based on a free float capitalisation method, a variation of the market capitalisation method. Instead of using a company's outstanding shares it uses its float, or shares that are readily available for trading. Free Floating capital implies total capitalization less Directors shareholding.[7] As per free float capitalisation methodology, the level of index at any point of time reflects the free float market value of 30 constituent stocks relative to a base period. The market capitalisation of a company is determined by multiplying the price of its stock by the number of shares issued by corporate actions, replacement of scrips. The index has increased by over twenty five times from June 1990 to the present. Using information from April 1979 onwards, the long-run rate of return on the S&P BSE SENSEX works 18.6% per annum.

Constituents

[edit]| Company | Symbol | Ticker Number | Sector | Entry date |

|---|---|---|---|---|

| Adani Ports & SEZ | ADANIPORTS.BO | 532921 | Ports & Port services | 24 June 2024[8] |

| Asian Paints | ASIANPAINT.BO | 500820 | Paints | 21 December 2015[9] |

| Axis Bank | AXISBANK.BO | 532215 | Banking - Private | |

| Bajaj Finance | BAJFINANCE.BO | 500034 | Finance (NBFC) | 24 December 2018[10] |

| Bajaj Finserv | BAJAJFINSV.BO | 532978 | Finance (Investment) | |

| Bharti Airtel | BHARTIARTL.BO | 532454 | Telecommunications | |

| HCLTech | HCLTECH.BO | 532281 | IT Services & Consulting | 24 December 2018[10] |

| HDFC Bank | HDFCBANK.BO | 500180 | Banking - Private | |

| Hindustan Unilever | HINDUNILVR.BO | 500696 | FMCG | |

| ICICI Bank | ICICIBANK.BO | 532174 | Banking - Private | |

| IndusInd Bank | INDUSINDBK.BO | 532187 | Banking - Private | 18 December 2017[11] |

| Infosys | INFY.BO | 500209 | IT Services & Consulting | |

| ITC | ITC.BO | 500875 | Cigarettes & FMCG | |

| JSW Steel | JSWSTEEL.BO | 500228 | Steel | 13 July 2023[12] |

| Kotak Mahindra Bank | KOTAKBANK.BO | 500247 | Banking - Private | 19 June 2017[13] |

| Larsen & Toubro | LT.BO | 500510 | Engineering & Construction | |

| Mahindra & Mahindra | M&M.BO | 500520 | Automobile | |

| Maruti Suzuki | MARUTI.BO | 532500 | Automobile | |

| Nestlé India | NESTLEIND.BO | 500790 | FMCG | 23 December 2019[14] |

| NTPC | NTPC.BO | 532555 | Power generation/Distribution | |

| Power Grid | POWERGRID.BO | 532898 | Power generation/Distribution | 20 June 2016[15] |

| Reliance Industries | RELIANCE.BO | 500325 | Conglomerate | |

| State Bank of India | SBIN.BO | 500112 | Banking - Public | |

| Sun Pharma | SUNPHARMA.BO | 524715 | Pharmaceuticals | 8 August 2011[16] |

| Tata Consultancy Services | TCS.BO | 532540 | IT Services & Consulting | |

| Tata Motors | TATAMOTORS.BO | 500570 | Automobile | |

| Tata Steel | TATASTEEL.BO | 500470 | Steel | 21 June 2021[17] |

| Tech Mahindra | TECHM.BO | 532755 | IT Services & Consulting | |

| Titan Company | TITAN.BO | 500114 | Diamond & Jewellery | 23 December 2019[14] |

| UltraTech Cement | ULTRACEMCO.BO | 532538 | Cement | 23 December 2019[14] |

Former constituents

[edit]Record values

[edit]| Category | All-time highs[30] | |

|---|---|---|

| Closing | 85,836.12 | Thursday, 26 September 2024 |

| Intra-day | 85,978.25 | Friday, 27 September 2024 |

Milestones

[edit]

The following is a timeline on the rise of the SENSEX through Indian stock market history.

- 1000, 25 July 1990 – On 25 July 1990, the SENSEX touched the four-digit figure for the first time and closed at 1,001 in the wake of a good monsoon and excellent corporate results.

- 2000, 15 January 1992 – On 15 January 1992, the SENSEX crossed the 2,000 mark and closed at 2,020 followed by the liberal economic policy initiatives undertaken, under the leadership of the then prime minister PV Narasimha Rao, by the then finance minister and former Prime Minister of India Dr. Manmohan Singh.

- 3000, 29 February 1992 – On 29 February 1992, the SENSEX surged past the 3,000 mark in the wake of the market-friendly budget announced by Manmohan Singh.

- 4000, 30 March 1992 – On 30 March 1992, the SENSEX crossed the 4,000 mark and closed at 4,091 on the expectations of a liberal export-import policy. It was then that the Harshad Mehta scam hit the markets and SENSEX witnessed unabated selling.

- 5000, 11 October 1999 – On 11 October 1999, the SENSEX crossed the 5,000 mark, as the Bharatiya Janata Party-led coalition won the majority in the 13th Lok Sabha election.[31]

- 6000, 11 February 2000 – On 11 February 2000, the information technology boom helped the SENSEX to cross the 6,000 mark and hit an all-time high of 6,006 points. This record would stand for nearly four years, until 2 January 2004, when the SENSEX closed at 6,026.59 points.[32]

- 7000, 21 June 2005 – On 20 June 2005, the news of the settlement between the Ambani brothers boosted investor sentiments and the scrips of RIL, Reliance Energy, Reliance Capital and IPCL made huge gains. This helped the SENSEX crossed 7,000 points for the first time.

- 8000, 8 September 2005 – On 8 September 2005, the Bombay Stock Exchange's benchmark 30-share index – the SENSEX – crossed the 8,000 level following brisk buying by foreign and domestic funds in early trading.

- 9000, 9 December 2005 – The SENSEX on 28 November 2005 crossed 9,000 and touched a peak of 9,000.32 points during mid-session at the Bombay Stock Exchange on the back of frantic buying spree by foreign institutional investors and well supported by local operators as well as retail investors. However, it was on 9 December 2005 that the SENSEX first closed at over 9,000 points.[33]

- 10,000, 7 February 2006 – The SENSEX on 6 February 2006 touched 10,003 points during mid-session. The SENSEX finally closed above the 10,000 mark on 7 February 2006.

- 20,000, 11 December 2007 – The SENSEX on 29 October 2007 crossed the 20,000 mark for the first time during intra-day trading, but closed at 19,977.67 points. However, it was on 11 December 2007 that it finally closed at a figure above 20,000 points on the back of aggressive buying by funds.[31]

- 21,000, 5 November 2010 – The SENSEX on 8 January 2008 crossed the 21,000 mark for the first time, reaching an intra-day peak of 21,078 points, before closing at 20,873.[34] However, it was not until 5 November 2010 that the SENSEX closed at 21,004.96, for its first close above 21,000 points.[35] This record would stand for nearly three years, until 30 October 2013, when the SENSEX closed at 21,033.97 points.[36]

- 19 February 2013 – SENSEX becomes S&P SENSEX as BSE ties up with Standard and Poor's to use the S&P brand for Sensex and other indices.[37]

- 13 March 2014 - The SENSEX closes higher than the Hang Seng Index, to become the major Asian stock market index with the highest value, for the first time ever.

- 22,000, 24 March 2014 – The SENSEX on 10 March 2014 crossed the 22,000 mark for the first time during intra-day trading. However, it was on 24 March 2014 that the index finally closed above the milestone[38] at 22,095.30.[39]

- 23,000, 9 May 2014 - The SENSEX crossed record 23,000 level for the first time, but close just short of the milestone level, on 9 May 2014. The index would close well above the 23,000 mark during the following session.

- 12 May 2014 - The SENSEX closed at its record all-time high of 23,551, a rise of 2.42%(+556.77 points) intraday due to continued fund inflows on hopes of a stable government.[40]

- 24,000, 13 May 2014 - The SENSEX crossed record 24,000 level for the first time, on 13 May 2014 and reached its peak of 24,067.11 due to sustained capital inflows by foreign funds at the domestic bourses and widespread buying by retail investors after exit polls showing the BJP-led NDA forming the government lifted the key indices to new highs. However it closed at a little low at 23,905 points[41]

- 25,000, 16 May 2014 - The SENSEX crossed record 25,000 level for the first time, on 16 May 2014 and reached its peak of 25,364.71 due to winning of the BJP led NDA government by a staggering record marginal difference of all times. However, it closed well below the 25,000 mark. Still, the index closed at its all-time high of 24,121.74, for its first close above 24,000 points.[42] The SENSEX closed at 25,019.51, for its first close above the 25,000 milestone on 5 June 2014[43]

- 26,000, 7 July 2014- The SENSEX crossed record 26,000 level for the first time on 7 July 2014 and reached its peak of 26,123.55, before closing slightly lower at 26,100.08, in anticipation of strong reformatory budget by the new government.[44]

- 27,000, 2 September 2014 - The SENSEX closed at 27,019.39, for its first close above the 27,000 level, on 2 September 2014.[45] This is the sixth 1000-point milestone the index has crossed in 2014, tying a record set in 2007.

- 28,000, 5 November 2014 - The SENSEX crossed 28,000 mark, on 5 November 2014.[46] One week later, on 12 November 2014, the index would close above the milestone for the first time.[47] This is the seventh 1000-point milestone the index has crossed in 2014, breaking the six 1000-point record set in 2007.

- 29,000, 23 January 2015 - BSE Sensex today set a new high of 29,408 points and all-time closing high of 29,278.84, up 272.82 points[48]

- 30,000, 4 March 2015 - The Sensex breaches 30000 mark following steps taken by the Reserve Bank of India in cutting the repo rates.

- 26 April 2017 - The SENSEX closed at 30,133.35, for its first close above the 30,000 level.[49]

- 31,000, 26 May 2017- The SENSEX crossed record 31,000 level for the first time on 26 May 2017 and reached its peak of 31,074.07, before closing slightly lower at 31,028.21.[50]

- 32,000, 13 July 2017 - The SENSEX closed at 32,037.38, for its first close above the 32,000 level, on 13 July 2017.[51]

- 33,000, 25 October 2017 - The SENSEX closed at 33,042.50, for its first close above the 33,000 level.[52]

- 34,000, 26 December 2017 - The SENSEX closed at 34,010.62, for its first close above the 34,000 level.[53]

- 35,000, 17 January 2018 - The SENSEX closed at 35,081.82, for its first close above the 35,000 level.[54]

- 36,000, 23 January 2018 - The SENSEX closed at 36,139.98, for its first close above the 36,000 level.[55]

- 37,000, 27 July 2018 - The SENSEX on 26 July 2018 crossed the 37,000 mark for the first time during intra-day trading. On 27 July 2018 the index closed above the milestone.[56]

- 38,000, 9 August 2018 - For the first time SENSEX passed the score of 38,000 during intra-day trading, and then closed at 38,024.37.[57]

- 39,000, 1 April 2019 – The SENSEX on 1 April 2019 crossed the 39,000 mark for the first time during intra-day trading.

- 2 April 2019 – The SENSEX closed at 39,056.65, for its first close above the 39,000 level.

- 40,000, 23 May 2019 – The SENSEX crossed "40,000.100" at 10:45 AM for the first time. (2019 Loksabha (House of the People) Election results were getting published)[58]

- 41,000, 26 November 2019 – The SENSEX crossed "41,120.28" first time during intraday trading.[59]

- 42,000, 16 January 2020 - The SENSEX crossed 42,000 mark with an all-time high of 42,059.45 at around 09:47 AM.[60]

- 45,000, 4 December 2020 - The SENSEX crossed 45,000 mark with an all-time high of 45,033 at around 10:30 AM.[61]

- 46,000, 9 December 2020 - The SENSEX crossed 46,000 mark with an all-time high of 46,017 at around 1:30 PM.

- 50,000, 21 January 2021 - The SENSEX crossed 50,000 mark with an all-time high of 50,181 at around 1:31 PM.

- 60,000, 24 September 2021 - The SENSEX crossed 60,000 mark with an all-time high of 60,218 at around 9:30 AM.

- 70,000, 11 December 2023 - The SENSEX crossed 70,000 mark with an all-time high of 70,057.83 at around 10:25 AM.

- 80,000, 3 July 2024 - The SENSEX crossed the 80,000 mark with an all time high of 80,074.30 at around 9:52 AM.

The SENSEX since 2006

[edit]May–December 2006

[edit]On 22 May 2006, the SENSEX plunged by 1,100 points during intra-day trading, leading to the suspension of trading for the first time since 17 May 2004. The volatility of the SENSEX had caused investors to lose ₹6 lakh crore (US$131 billion) within seven trading sessions. The then Finance Minister of India, P. Chidambaram, made an unscheduled press statement when trading was suspended to assure investors that nothing was wrong with the fundamentals of the economy, and advised retail investors to stay invested. When trading resumed after the reassurances of the Reserve Bank of India and the Securities and Exchange Board of India (SEBI), the SENSEX managed to move up 700 points, but still finished the session 457 points in the red.[62]

The SENSEX eventually recovered from the volatility, and on 16 October 2006, the SENSEX closed at an all-time high of 12,928.18 with an intra-day high of 12,953.76. This was a result of increased confidence in the economy and reports that India's manufacturing sector grew by 11.1% in August 2006.

- 13,000, 30 October 2006 – The SENSEX on 30 October 2006 crossed 13,000 mark for the first time, touching a peak of 13,039.36, before closing at 13,024.26 points. It took 135 days to reach 13,000 from 12,000, and 124 days to reach 13,000 from 12,500.

- 14,000, 5 December 2006 – The SENSEX on 5 December 2006 crossed 14,000 mark for the first time, after opening the day with a peak of 14,028 at 9.58 am (IST).

July–September 2007: Effects of the subprime crisis in U.S.

[edit]- 15,000, 6 July 2007- The SENSEX on 6 July 2007 crossed another milestone and reached a magic figure of 15,000. It took 7 months and one day after first reaching the 14,000 milestone to touch this historic milestone.

On 23 July 2007, the SENSEX touched a new high of 15,733 points. On 27 July 2007 the SENSEX witnessed a huge decline because of selling by Foreign Institutional Investors and global cues to come back to 15,160 points by noon. Following global cues and heavy selling in the international markets, the BSE SENSEX fell by 615 points in a single day on 1 August 2007.[63]

- 16,000, 19 September 2007- The SENSEX on 19 September 2007 crossed the 16,000 mark, closing at a historic peak of 16,322. The bull hits because of the rate cut of 50 bit/s in the discount rate by the Fed chief Ben Bernanke.

- 17,000, 26 September 2007- On 26 September 2007, the SENSEX crossed the 17,000 mark for the first time, creating a record for the second fastest 1000 point gain in just 5 trading sessions. It failed however to sustain the momentum and closed below 17,000. The SENSEX closed above 17,000 for the first time on the following day. Reliance group has been the main contributor in this bull run, contributing 256 points. This also helped Mukesh Ambani's net worth to grow to over ₹2 lakh crore ($50 billion). It was also during this record bull run that the SENSEX for the first time zoomed ahead of the Nikkei of Japan.

October–December 2007: Participatory notes issue

[edit]- 18,000, 9 October 2007- The SENSEX crossed the 18,000 mark for the first time on 9 October 2007, gaining 788 points, to close at 18,280. The journey from 17,000 to 18,000 took just 8 trading sessions, which is the third fastest 1000-point rise in the history of the SENSEX.

- 19,000, 15 October 2007- The SENSEX crossed the 19,000 mark for the first time on 15 October 2007, gaining 640 points, to close at 19,059. It took just 4 trading sessions for the SENSEX to move from 18,000 to 19,000. This is the fastest 1000-point rise ever for the index. In addition, the rise from 16,000 to 19,000 in 17 trading sessions sets a record for the fastest 3,000-point rally in the history of the SENSEX.

On 16 October 2007, SEBI (Securities & Exchange Board of India) proposed curbs on participatory notes which accounted for roughly 50% of FII investment in 2007. SEBI was not happy with P-notes because it was not possible to know who owned the underlying securities, and hedge funds acting through P-notes might therefore cause volatility in the Indian markets.

However the proposals of SEBI were not clear and this led to a knee-jerk crash when the markets opened on the following day (17 October 2007). Within a minute of opening trade, the SENSEX crashed by 1,744 points or about 9% of its value – the biggest intra-day fall in Indian stock markets in absolute terms until then. This led to the automatic suspension of trade for one hour. Finance Minister P. Chidambaram issued clarifications, in the meantime, that the government was not against FIIs and was not immediately banning PNs. After the market opened at 10:55 am, the index staged a comeback and ended the day at 18715.82, down 336.04 from the last day's close.

However, this would not be the end of the volatility. The next day (18 October 2007), the SENSEX tumbled by 717.43 points – 3.83 per cent – to close at 17,998.39 points. The slide continued the next day (19 October 2007), when the SENSEX fell 438.41 points to settle at 17,559.98 to the end of the week, after touching the lowest level of that week at 17,226.18 during the day.

After detailed clarifications from the SEBI chief M. Damodaran regarding the new rules, the market made an 879-point gain on 23 October, thus signalling the end of the PN crisis.

- 20,000, 11 December 2007- On 29 October 2007, the SENSEX crossed the 20,000 mark for the first time with a massive 734.5-point gain, but closed below the 20,000 mark. The SENSEX would close above the 20,000 mark for the first time on 11 December 2007. It took 42 days after reaching the 19,000 milestone to close above 20,000 points for the first time. The journey of the last 10,000 points was covered in just 483[64] sessions, compared to 7,297 sessions taken to touch the 10,000 mark from its base value of 100 points. In the second half of 2007 alone, the SENSEX reached six 1,000-point milestones.

May 2009

[edit]On 18 May 2009, the SENSEX surged up 2,110.79 points to close at 14,285.21, from its previous closing of 12,174.42, for its largest single day rally. Less than a month later, on 4 June 2009, the SENSEX would cross the 15,000 mark.

However, the SENSEX remained volatile during the summer of 2009. The SENSEX plunged by 869.65 points on 6 July 2009, the day of Union Budget presentation in Parliament on concerns over high fiscal deficit. This was the biggest Budget-day loss for the index.[31] On 17 August 2009, the SENSEX lost 626.71 points.

Once again, the SENSEX would recover from the volatility. On 7 September 2009, the SENSEX crossed the 16,000 mark, closing at 16,016.32 points. The index would gain 3,000 points over the next 12 months, as the SENSEX crossed the 19,000 mark on 13 September 2010, closing at 19,208.33 points.

- 21,000, 5 November 2010 - The SENSEX closed at 21,004.96, for its first close above the 21,000 mark. It would take nearly three years for the index to make its next close above this level.

- 22,000, 24 March 2014 - The SENSEX closed at 22,055.48, for its first close above the 22,000 mark. For the first time, the SENSEX zoomed ahead of the Hang Seng Index.

- 23,000, 12 May 2014 - The SENSEX closed at 23,551.00, for its first close above the 23,000 mark,

- 24,000, 16 May 2014 - The SENSEX closed at 24,121.74, for its first close above the 24,000 mark, Breaking all previous records and above all other indexes in the world.

- 25,000, 5 June 2014 - The SENSEX closed at 25,019.51, for its first close above the 25,000 mark,

- 26,000, 7 July 2014 - The SENSEX closed at 26,123.55, for its first close above the 26,000 mark,

- 27,000, 2 September 2014 - The SENSEX closed at 27019.39, for its first close above the 27,000 mark,

- 28,000, 5 November 2014 - The SENSEX crossed 28,000 mark, on 5 November 2014.[46] This is the seventh 1000-point milestone the index has crossed in 2014, breaking the six 1000-point record set in 2007.

Major SENSEX stock market plunges

[edit]January 2008

[edit]In the third week of January 2008, the SENSEX experienced huge falls along with other markets around the world. On 21 January 2008, the SENSEX saw its highest ever loss of 1,408 points at the end of the session. The SENSEX recovered to close at 17,605.40 after it tumbled to the day's low of 16,963.96, on high volatility as investors panicked following weak global cues amid fears of a recession in US.

The next day, the BSE SENSEX index went into a free fall. The index hit the lower circuit breaker in barely a minute after the markets opened at 10 am. Trading was suspended for an hour. On reopening at 10.55 am IST, the market saw its biggest intra-day fall when it hit a low of 15,332, down 2,273 points. However, after reassurance from the Finance Minister of India, the market bounced back to close at 16,730 with a loss of 875 points.[65]

Over the course of two days, the BSE SENSEX in India dropped from 19,013 on Monday morning to 16,730 by Tuesday evening or a two-day fall of 13.9%.[65] Less than a month later, on 11 February 2008, the SENSEX lost 833.98 points, when Reliance Power fell below its IPO price in its debut trade after a high-profile public offer.[31]

March 2008

[edit]The free fall of the SENSEX accelerated in March 2008. The month started out with the Sensex losing 900.84 points on 3 March 2008, on concerns emanating from growing credit losses in US. This would be the first of four one-day falls of greater than 700 points during the month. On 13 March 2008, the SENSEX plummeted another 770.63 points on global economic jitters.[31]

- 14,810, 17 March 2008 - The SENSEX dropped by 951.03 points on the global credit crisis and distress, to fall below the 15,000 mark, closing at 14,810.[31]

The month ended with the SENSEX shedding 726.85 points on 31 March 2008, after heavy selling in blue-chip stocks on global economic fears.

- 13,802, 27 June 2008 - The SENSEX dropped by 600 points, to fall below the 14,000 mark, closing at 13,802.

- 12,962, 1 July 2008 - The SENSEX falls below the 13,000 mark, closing at 12,962.[31]

- 11,802, 6 October 2008 - The SENSEX dropped by 724.62 points amid fears of the US recession and attempts by governments across the world to save their failing banks, to fall below the 12,000 mark, closing at 11,802.[31]

- 10,527, 10 October 2008 - The SENSEX dropped by 800.51 points amid weak industrial production data and concerns over impact of global economic crisis on IT and banking firms in India,[31] to fall below the 11,000 mark, closing at 10,527.

- 9,975, 17 October 2008 – The SENSEX crashes below the psychological 5-figure mark of 10,000 points, closing at 9,975.35, following extremely negative global financial indications in US and other countries. Just ten months earlier, in December 2007, SENSEX had closed above the 20,000 mark for the first time.

- 8,701.07, 24 October 2008 - The SENSEX lost 10.96% of its value (1070.63 points) on the intra-day trade, closing at 8,701.07, for its first close below the 9,000 mark since 14 June 2006, after RBI lowered its GDP growth forecasts on global economic concerns.[31] The loss was the 2nd highest in terms of total points, and the 3rd highest percentage-wise, for a one-day period in the index's history.

- 8,509.56, 27 October 2008 - The SENSEX hit an intra-day low of 7,697.39, before closing at 8,509.56,[31] for its lowest close since 14 November 2005.

Early 2009

[edit]The SENSEX dropped by 749.05 points on 7 January 2009, when the Satyam fraud came to light.[31]

- 8,160.40, 9 March 2009 - The SENSEX closed at 8,160.40, for its lowest close since 2 November 2005.

2015

[edit]The index crossed the historical mark of 30,000 after repo rate cut announcement by RBI.[66]

The index plummeted by over 1,624.51 points on 24 August 2015, the then worst one-day point plunge in the index's history.[67]

2020

[edit]On 9 March 2020, Sensex tumbled down by 1941.67 points amid the fears of coronavirus pandemic and Yes Bank crisis.[68] This was the second worst single-day fall in the history, where the investors lost ₹6.50 lakh crores ($91 billion).[citation needed] While on 12 March 2020, the index plunged down by 2919.26 points, the second–worst fall in the history, ending in red to a 33-month low at 32,778.14. The fall wiped off ₹11.2 lakh crores wealth ($160 billion).[69]

On Friday, 13 March, trading was halted for 45 minutes for the first time in 12 years since January 2008 due to lower circuit.[70] Sensex touched a low of 29,687.52 down by 3090.62 points (or 9.43%). However, after the 45-minute halt, the index saw biggest intra-day recovery by 5,380 points to end up by 1325 points.[71]

Continuing the losing streak, wealth worth ₹14.22 lakh crore ($200 Billion) was erased on 23 March 2020 as BSE SENSEX lost 3,934.72 points to end at 25,981.24.[72]

As on 21 January 2021, Sensex has recovered to 50,167.71.[citation needed]

Major falls

[edit]On the following dates, the SENSEX index suffered major single-day falls at close (of 430 or more points):[73]

| S.No. | Date | Points | Reason |

|---|---|---|---|

| 1 | 28 April 1992 | 570[74] | |

| 2 | 17 May 2004 | 565 | |

| 3 | 15 May 2006 | 463 | |

| 4 | 18 May 2006 | 826[75] | |

| 5 | 19 May 2006 | 453 | |

| 6 | 22 May 2006 | 457 | |

| 7 | 2 April 2007 | 617 | |

| 8 | 1 August 2007 | 615 | |

| 9 | 16 August 2007 | 642.70 | |

| 10 | 17 October 2007 | 717.43 | |

| 11 | 21 November 2007 | 678.18 | |

| 12 | 17 December 2007 | 769.48 | |

| 13 | 18 January 2008 | 687.82 | |

| 14 | 21 January 2008 | 1408.35[76] | Due to the US subprime mortgage crisis. |

| 15 | 22 January 2008 | 875 | Due to the US subprime mortgage crisis. |

| 16 | 11 February 2008 | 833.98 | |

| 17 | 3 March 2008 | 900.84 | |

| 18 | 13 March 2008 | 770.63 | |

| 19 | 17 March 2008 | 951.03[77] | |

| 20 | 31 March 2008 | 726.85 | |

| 21 | 27 June 2008 | 600 | |

| 22 | 15 September 2008 | 710 | |

| 23 | 6 October 2008 | 724.62 | |

| 24 | 10 October 2008 | 792.17 | |

| 25 | 24 October 2008 | 704 | |

| 26 | 7 January 2009 | 749.05 | |

| 27 | 6 July 2009 | 869.65[78] | |

| 28 | 17 August 2009 | 626.71 | |

| 29 | 12 November 2010 | 432 | |

| 30 | 16 November 2010 | 444.55 | |

| 31 | 4 February 2011 | 441.92 | |

| 32 | 24 February 2011 | 545.92 | |

| 33 | 22 September 2011 | 704[79] | |

| 34 | 27 February 2012 | 477.82 | |

| 35 | 13 May 2013 | 430.65[80] | |

| 36 | 31 May 2013 | 455.10 | |

| 37 | 20 June 2013 | 526.41[81] | |

| 38 | 6 August 2013 | 449.22[82] | |

| 39 | 16 August 2013 | 769.41 | Due to depreciation of the Indian rupee.[83][84] |

| 40 | 27 August 2013 | 590.05[85] | |

| 41 | 3 September 2013 | 651.47 | |

| 42 | 18 November 2013 | 451.32 | |

| 43 | 8 July 2014 | 517.97 | |

| 44 | 16 December 2014 | 538.12 | |

| 45 | 6 January 2015 | 854.86[86] | |

| 46 | 30 January 2015 | 498.82 | |

| 47 | 9 February 2015 | 490.52 | |

| 48 | 9 March 2015 | 604.17 | |

| 49 | 26 March 2015 | 654.25 | |

| 50 | 5 May 2015 | 722 | |

| 51 | 24 August 2015 | 1624.51[87] | Driven by the meltdown in the Chinese stock market.[88] |

| 52 | 22 September 2015 | 541.14[89] | |

| 53 | 4 January 2016 | 537.55 | |

| 54 | 7 January 2016 | 554.50[90] | |

| 55 | 11 February 2016 | 807.07[91] | |

| 56 | 11 November 2016 | 698.86[92] | Driven by 2016 US Election Results.[93] |

| 57 | 2 February 2018 | 839.91[94] | Driven by 2018 Union Budget of India.[95] |

| 58 | 4 October 2018 | 806.47[96] | Panic fall, due to oil price increase and rupee fall against US Dollar.[97] |

| 59 | 5 October 2018 | 800.51 | Panic fall, due to oil price increase and rupee fall against US Dollar.[97] |

| 60 | 8 July 2019 | 792.82[98] | Driven by Union Budget and global equity sell off. |

| 61 | 13 August 2019 | 624[99] | |

| 62 | 22 August 2019 | 587.44[100] | Due to concerns about slowing Indian economy.[100] |

| 62 | 6 January 2020 | 787.98[101] | |

| 63 | 1 February 2020 | 987.96[102] | Driven by 2020 Union Budget of India. |

| 64 | 28 February 2020 | 1448.37[103] | Driven by coronavirus outbreak. |

| 65 | 6 March 2020 | 893.99[104] | Due to global sell-off driven by coronavirus concerns. |

| 66 | 9 March 2020 | 1941.67[105] | Due to coronavirus concerns. |

| 67 | 12 March 2020 | 2919.26[106] | Due to coronavirus concerns. |

| 68 | 16 March 2020 | 2713.41[107] | Due to coronavirus concerns. |

| 69 | 17 March 2020 | 810.98[108] | Due to coronavirus concerns and fears of recession. |

| 70 | 18 March 2020 | 1709.58[109] | Due to the COVID-19 pandemic.[110] |

| 71 | 19 March 2020 | 581.28[111] | Due to the COVID-19 pandemic. |

| 72 | 23 March 2020 | 3934.72[112] | Due to the COVID-19 pandemic and nationwide lockdown. |

| 73 | 1 April 2020 | 1203.18[113] | Due to the COVID-19 pandemic. |

| 74 | 3 April 2020 | 674.36[114] | Due to the COVID-19 pandemic. |

| 75 | 24 April 2020 | 535.86[115] | Due to the COVID-19 pandemic. |

| 76 | 4 May 2020 | 2002.27[116] | Due to the COVID-19 pandemic. |

| 77 | 14 May 2020 | 885.72[117] | Due to the COVID-19 pandemic. |

| 78 | 18 May 2020 | 1068.75[118] | Due to the COVID-19 pandemic. |

| 79 | 11 June 2020 | 708.68[119] | Driven by global equity sell-off.[119] |

| 80 | 5 April 2021 | 708.69[120] | Due to the second wave of coronavirus in India.[120] |

| 81 | 13 April 2021 | 1708[121] | Due to second wave of coronavirus and lockdown threats. |

| 82 | 31 October 2021 | 677.77[122] | Continuous selling by FIIs, dull global performance and mixed corporate earnings. |

| 83 | 24 February 2022 | 2702.15[123] | Driven by Russian invasion of Ukraine |

| 84 | 19 May 2022 | 1416.30[124] | Driven by inflation concerns |

| 85 | 4 June 2024 | 4389.73[125] | Driven due to 2024 Lok Sabha election |

| 86 | 5 August 2024 | 2222.55 [126][127] | The global sell-off was primarily driven by fears of a U.S. recession, weak U.S. unemployment data, geopolitical tensions, and the unwinding of the Yen trade. |

Major highs

[edit]| Sl. No. | Date | High | Reason |

|---|---|---|---|

| 1 | 31 Oct 2019 | 40,392.22 | Continuous buying by foreign institutional investors (FIIs).

Tax cut buzz. US Fed rate cut. US-China trade hopes. Corporate results being better than expected.[128] |

| 2 | 20 Nov 2019 | 40,816.38 | Trade lifted by buying in index heavyweights like Reliance Industries, Bharti Airtel, and ICICI Bank.[129] |

| 3 | 20 Dec 2019 | 41,809.96 | FII's inflows & gains by Tata Steel, SBI & Yes Bank[130] |

See also

[edit]- Bombay Stock Exchange

- National Stock Exchange of India

- NIFTY 50

- List of stock market crashes and bear markets

- List of stock market indices

- List of major stock exchanges

- List of countries by stock market capitalization

- Stock market index

- Nasdaq

- S&P 500

References

[edit]- ^ a b "BSE Sensex - Live Sensex and Stock Values". BSE India. Archived from the original on 15 July 2024. Retrieved 13 September 2024. Alt URL

- ^ "What is Sensex - Meaning, Milestones, Calculation". Groww. Archived from the original on 9 June 2024. Retrieved 9 June 2024.

- ^ "BSE Sensex is now 25". Press Information Bureau. Archived from the original on 10 June 2024. Retrieved 9 June 2024.

- ^ "What is Dollex and how it is Different From Sensex | IIFL Knowledge Center". www.indiainfoline.com. Archived from the original on 19 August 2022. Retrieved 9 June 2024.

- ^ Shinde, Ranjit (8 August 2008). "Will Nelson's magic work again for Sensex on Friday?". The Economic Times. Archived from the original on 9 June 2024. Retrieved 3 September 2021.

- ^ Staney, Nesil (29 May 2008). "He coined the term Sensex and he now wants a trademark for it". Livemint. Archived from the original on 9 June 2024. Retrieved 19 May 2020.

- ^ "How the Sensex is calculated". Archived from the original on 25 November 2017. Retrieved 12 November 2017.

- ^ a b "Adani Ports to replace IT major Wipro in BSE Sensex from June 24". The New Indian Express. 25 May 2024. Retrieved 19 July 2024.

- ^ "20151120-9 - Reconstitution of S&P BSE Indices". BSE. 20 November 2015. Archived from the original on 29 August 2017. Retrieved 29 August 2017.

- ^ a b "Reconstitution of S&P BSE Indices". BSE. 22 November 2018. Archived from the original on 12 January 2019. Retrieved 12 January 2019.

- ^ "20171117-23 - Reconstitution of S&P BSE Indices". BSE. 17 November 2017. Archived from the original on 29 January 2018. Retrieved 29 January 2018.

- ^ "Index Rejig: JSW Steel to replace HDFC in Sensex from July 13". The Economic Times. 5 July 2023. Archived from the original on 5 July 2023. Retrieved 15 September 2023.

- ^ "20170519-15 - Reconstitution of S&P BSE Indices". BSE. 19 May 2017. Archived from the original on 29 August 2017. Retrieved 29 August 2017.

- ^ a b c "Titan Company, UltraTech Cement, Nestle India in focus on Sensex inclusion". Business Standard. 23 December 2019. Archived from the original on 14 January 2020.

- ^ "20160520-25 - Reconstitution of S&P BSE Indices". BSE. 20 May 2016. Archived from the original on 29 August 2017. Retrieved 29 August 2017.

- ^ "Coal India, Sun Pharma to enter Sensex on Monday". BusinessLine. PTI. 7 August 2011. Archived from the original on 30 January 2018. Retrieved 30 January 2018.

- ^ a b c "Tata Steel to re-enter Sensex after six months, replaces ONGC on June 21". Business Standard. Archived from the original on 15 May 2024. Retrieved 15 May 2024.

- ^ a b "Coal India, Sun Pharma to enter Sensex on Monday". BusinessLine. PTI. 7 August 2011. Archived from the original on 30 January 2018. Retrieved 30 January 2018.

- ^ "20150522-22 - Reconstitution of S&P BSE Indices". BSE. 22 May 2015. Archived from the original on 29 August 2017. Retrieved 29 August 2017.

- ^ "20151120-9 - Reconstitution of S&P BSE Indices". BSE. 20 November 2015. Archived from the original on 29 August 2017. Retrieved 29 August 2017.

- ^ "20160520-25 - Reconstitution of S&P BSE Indices". BSE. 20 May 2016. Archived from the original on 29 August 2017. Retrieved 29 August 2017.

- ^ "20170519-15 - Reconstitution of S&P BSE Indices". BSE. 19 May 2017. Archived from the original on 29 August 2017. Retrieved 29 August 2017.

- ^ a b "20171117-23 - Reconstitution of S&P BSE Indices". BSE. 17 November 2017. Archived from the original on 29 January 2018. Retrieved 29 January 2018.

- ^ "Reconstitution of S&P BSE Indices". BSE. 18 May 2018. Archived from the original on 12 January 2019. Retrieved 12 January 2019.

- ^ a b "Reconstitution of S&P BSE Indices". BSE. 22 November 2018. Archived from the original on 12 January 2019. Retrieved 12 January 2019.

- ^ a b c "Yes Bank, Tata Motors, Vedanta to be removed from Sensex from Dec 23". Moneycontrol.com. 22 November 2019. Retrieved 14 January 2020.

- ^ "Wipro to replace Bajaj Auto in Sensex". The Economic Times. Archived from the original on 15 May 2024. Retrieved 15 May 2024.

- ^ "Tata Motors to replace Dr Reddy's in Sensex". BusinessLine. 18 November 2022. Archived from the original on 15 May 2024. Retrieved 15 May 2024.

- ^ "JSW Steel to replace HDFC in Sensex from July 13". The Indian Express. 5 July 2023. Archived from the original on 15 May 2024. Retrieved 15 May 2024.

- ^ "Sensex, Nifty draw back from lifetime highs on profit taking; HDFC Bank, ICICI major laggards". The Hindu. 27 September 2024. Archived from the original on 28 September 2024. Retrieved 28 September 2024.

- ^ a b c d e f g h i j k l "Ups and Downs of Sensex". bemoneyaware.com. 23 September 2012. Archived from the original on 25 March 2013. Retrieved 21 May 2013.

- ^ "Funds Hope to Ride on the Boom". ArabNews. 5 January 2004. Archived from the original on 6 December 2012. Retrieved 14 June 2013.

- ^ "Sensex at 9k, bulls on Cloud 9 - Money". Daily News and Analysis. 10 December 2005. Retrieved 14 June 2013.

- ^ "Sensex hits 21,000; ends up 61 points". Rediff.com. 8 January 2008. Archived from the original on 4 July 2023. Retrieved 19 September 2011.

- ^ "Sensex closes above 21,000 level in Diwali Muhurat trade - Money". Daily News and Analysis. 5 November 2010. Retrieved 14 June 2013.

- ^ "Sensex ends at record high of 21,033.97, up 105 points". Daily News and Analysis. 30 October 2013. Archived from the original on 1 November 2013. Retrieved 18 February 2015.

- ^ Mohan, Vyas (19 February 2013). "Sensex to carry S&P tag". Livemint. Archived from the original on 8 May 2013. Retrieved 14 June 2013.

- ^ "Stable govt hope pushes Sensex to life-time high". Business Line. 24 March 2014. Archived from the original on 24 March 2014. Retrieved 18 February 2015.

- ^ Market, Capital (26 March 2014). "Sensex, Nifty attain record closing high". Business Standard. Archived from the original on 19 April 2014. Retrieved 18 February 2015.

- ^ "Sensex at new record high, Nifty breaches 7,000 mark". The Hindu. 12 May 2014. Archived from the original on 13 May 2014. Retrieved 18 February 2015.

- ^ "Sensex hits new record high of 23,922". The Hindu. 13 May 2014. Archived from the original on 14 May 2014. Retrieved 18 February 2015.

- ^ "Stock markets: BSE Sensex rallies to record high on Narendra Modi election 2014 win". The Indian Express. 16 May 2014. Archived from the original on 16 May 2014. Retrieved 18 February 2015.

- ^ "BSE Sensex closes above 25,000-level for the first time - Business Today". India Today. 5 June 2014. Archived from the original on 18 February 2015. Retrieved 18 February 2015.

- ^ "Sensex surges 138 points on hopes of business-friendly Budget". Business Line. 7 July 2014. Archived from the original on 10 June 2024. Retrieved 18 February 2015.

- ^ "Sensex ends above 27000, heavyweights lead show; cements up". Moneycontrol.com. 2 September 2014. Archived from the original on 2 September 2014. Retrieved 18 February 2015.

- ^ a b "BSE Sensex breaches 28,000-mark; Nifty at 8,363.65". The Indian Express. 5 November 2014. Archived from the original on 5 November 2014. Retrieved 18 February 2015.

- ^ "Sensex ends above 28000 for 1st time; Tata Steel slips 2%". Moneycontrol.com. 12 November 2014. Archived from the original on 12 November 2014. Retrieved 18 February 2015.

- ^ "Sensex hits fresh peak of 29,278, Nifty hits 8,835". Indiatvnews.com. 23 January 2015. Archived from the original on 23 January 2015. Retrieved 18 February 2015.

- ^ "The SENSEX closed at 30,133.35, for its first time close above the 30,000 level". Latest News Tamil. 23 June 2023. Archived from the original on 23 June 2023. Retrieved 23 June 2023.

- ^ "Sensex ends above 31,000 for the first time, Nifty at new peak". india.com. 26 May 2017. Archived from the original on 29 July 2020. Retrieved 26 May 2017.

- ^ "Sensex closes above 32,000-mark for first time, Nifty rallies too". The Times of India. 13 July 2017. Archived from the original on 14 July 2017. Retrieved 13 July 2017.

- ^ "Government's PSU bank package push Sensex, Nifty to record highs; SBI stock zooms". The Times of India. 25 October 2017. Archived from the original on 25 October 2017. Retrieved 25 October 2017.

- ^ "Closing bell: Sensex closes above 34,000 for the first time, Nifty at record high of 10,531". livemint.com. 26 December 2017. Archived from the original on 26 December 2017. Retrieved 26 December 2017.

- ^ "Sensex ends at fresh record high of 35,082 for first time; Nifty closes at 10,788". Business Line. 17 January 2018. Archived from the original on 10 June 2024. Retrieved 17 January 2018.

- ^ "Sensex, Nifty Settle at Fresh Record Highs". rttnews.com. 23 January 2018. Archived from the original on 23 January 2018. Retrieved 23 January 2018.

- ^ "Sensex logs new all-time high, Nifty too ends at record high; ITC, RIL, HDFC twins, ICICI Bank shares shine". The Financial Express. 27 July 2018. Archived from the original on 27 July 2018. Retrieved 28 July 2018.

- ^ "Sensex closes above 38,000 for first time, Nifty at 11,468". Zee News. 9 August 2018. Archived from the original on 9 August 2018. Retrieved 9 August 2018.

- ^ Setpal, Yash (23 May 2019). "Sensex on 23rd May 2019". goaleducation.co.in. Archived from the original on 26 June 2022. Retrieved 5 December 2019.

- ^ "Sensex retreats from lifetime high of 41,120, ends 68 points lower on profit-booking; Nifty ends above 12,000-mark". Firstpost. 26 November 2019. Archived from the original on 28 November 2019. Retrieved 26 November 2019.

- ^ "Market at record high: Sensex tops 42,000 for first time; Nifty nears 12,400". The Economic Times. 16 January 2020. Archived from the original on 22 February 2024. Retrieved 22 April 2024.

- ^ Reporter, S. I. (4 December 2020). "MARKET LIVE: Sensex off record high, still up 250 pts; financials gain". Business Standard. Retrieved 4 December 2020.

- ^ "The 10 Biggest Falls in Sensex History as of 2006". Rediff.com. Archived from the original on 10 June 2024. Retrieved 21 May 2013.

- ^ "The 10 Biggest Falls in Sensex History as of October 2008". Rediff.com. Archived from the original on 21 August 2013. Retrieved 21 May 2013.

- ^ "Market Watch: Sensex @ 10K: up in 483 days, down in 193. | AccessMyLibrary - Promoting library advocacy". AccessMyLibrary. Retrieved 14 June 2013.

- ^ a b "The 10 biggest falls in SENSEX history". MarketWatch. rediff Business Bureau. 21 January 2008. Archived from the original on 27 January 2008. Retrieved 15 September 2023.

- ^ "BSE Sensex crosses 30,000-mark; Nifty touches Record High". Odisha News Insight. 4 March 2015. Archived from the original on 27 July 2020. Retrieved 10 June 2020.

- ^ "Sensex slips nearly 6 pct; posts biggest fall in 6-1/2 years". Reuters India. 24 August 2015. Archived from the original on 21 August 2016. Retrieved 24 August 2015.

- ^ "Sensex Sinks 2,300 Points As Markets Suffer Biggest Crash in at Least 10 Years: 10 Points". NDTV.com. 9 March 2020. Archived from the original on 9 March 2020. Retrieved 9 March 2020.

- ^ "Bloodbath on Dalal Street as Sensex posts biggest one-day fall". Livemint. 12 March 2020. Archived from the original on 27 July 2020. Retrieved 12 March 2020.

- ^ "BSE, NSE halt trading for 1st time in 12 years. Circuit breaker limit explained". Livemint. 13 March 2020. Archived from the original on 18 April 2020. Retrieved 13 March 2020.

- ^ "Sensex stages a 5,400-point recovery: Decoding the sharp rally on Dalal Street". businesstoday.in. 13 March 2020. Archived from the original on 10 June 2024. Retrieved 13 March 2020.

- ^ "Sensex tumbles nearly 4,000 points, investors become poorer by ₹14.22 tn". Livemint. 23 March 2020. Archived from the original on 26 March 2020. Retrieved 26 March 2020.

- ^ "The Hindu News Update Service". The Hindu. Chennai, India. 22 January 2008. Archived from the original on 27 August 2011. Retrieved 19 September 2011.

- ^ "Biggest falls and gains of the Sensex". Rediff. Archived from the original on 28 February 2020. Retrieved 28 February 2020.

- ^ "Sensex's biggest-ever fall: 826 points". Rediff. Archived from the original on 22 February 2007. Retrieved 28 February 2020.

- ^ "Sensex registers biggest-ever fall, tumbles by 1,408.35 pts". OneIndia. 21 January 2008. Archived from the original on 28 February 2020. Retrieved 28 February 2020.

- ^ Barretto, Crystal (17 March 2008). "Sensex drops 951 points as fear, caution grips investors". The Economic Times. Archived from the original on 10 June 2024. Retrieved 28 February 2020.

- ^ "Sensex records highest Budget-day fall on deficit concerns". India Today. Press Trust of India. 6 July 2010. Archived from the original on 28 February 2020. Retrieved 28 February 2020.

- ^ "BSE Sensex plunges 704 points; biggest fall in 2 years". The Economic Times. 22 September 2011. Archived from the original on 10 June 2024. Retrieved 28 February 2020.

- ^ Shrivastava, Nitin (14 May 2013). "Just 6 stocks caused half of Sensex's 430-point fall". DNA India. Archived from the original on 28 February 2020. Retrieved 3 September 2013.

- ^ IANS (20 June 2013). "Rupee, Sensex slump as Fed signals stimulus exit (Roundup)". Business Standard India. Archived from the original on 28 February 2020. Retrieved 20 June 2013.

- ^ Anup Roy; Ami Shah (6 August 2013). "Sensex tanks 449 points as rupee slides to new record low". Livemint. Archived from the original on 28 February 2020. Retrieved 15 September 2023.

- ^ "News18.com: CNN-News18 Breaking News India, Latest News, Current News Headlines". News18. Archived from the original on 20 August 2013. Retrieved 21 December 2017.

- ^ "Sensex, Nifty reel as Brexit spooks world markets". Business Line. 24 June 2016. Archived from the original on 9 July 2019. Retrieved 9 July 2019.

- ^ "Re, Sensex sink on fears Food Bill will feed deficit". @businessline. 27 August 2013. Archived from the original on 28 February 2020. Retrieved 18 February 2015.

- ^ Anand, Kshitij (7 January 2015). "Sensex cracks 854 points amid global sell-off; top ten stocks to buy on declines". The Economic Times. Archived from the original on 8 December 2022. Retrieved 28 February 2020.

- ^ "Sensex crashes 1,624 points: The biggest ever market fall explained in seven graphics". Firstpost. 24 August 2015. Archived from the original on 10 June 2024. Retrieved 28 February 2020.

- ^ "Global mayhem: Sensex crashes 1624 pts; Nifty breaches 7900". Moneycontrol. 24 August 2015. Retrieved 21 December 2017.

- ^ "Sensex crashes 541 points over sell-off in European mkt". Deccan Herald. 23 September 2015. Archived from the original on 28 February 2020. Retrieved 28 February 2020.

- ^ "Sensex closes 554 points lower on China market rout". businesstoday.in. 7 January 2016. Archived from the original on 10 June 2024. Retrieved 28 February 2020.

- ^ "Sensex crashes 807 points as slowdown fears haunt markets again". Business Line. 11 February 2016. Archived from the original on 28 February 2020. Retrieved 28 February 2020.

- ^ "Sensex closes 698 points lower, Nifty below 8,300 level". businesstoday.in. 11 November 2016. Archived from the original on 10 June 2024. Retrieved 28 February 2020.

- ^ Nathan, Narendra (14 November 2016). "How demonetisation and Donald Trump's victory impact your investments". The Economic Times. Archived from the original on 9 June 2024. Retrieved 21 December 2017.

- ^ S. I. Reporter (2 February 2018). "Sensex tanks 2.5%, down 839 pts, Nifty ends below 10,800 on Budget woes". Business Standard India. Archived from the original on 28 February 2020. Retrieved 28 February 2020.

- ^ S. I. Reporter (2 February 2018). "Sensex tanks 2.5%, down 839 pts, Nifty ends below 10,800 on Budget woes". Business Standard India. Archived from the original on 28 February 2020. Retrieved 10 June 2020.

- ^ "BSE sensex: Market bloodbath: Sensex sheds 806 points; Nifty closes below 11,600". The Times of India. 4 October 2018. Archived from the original on 8 January 2020. Retrieved 28 February 2020.

- ^ a b Mudgill, Amit (4 October 2018). "Sensex cracks 4,000 pts in 24 days! History still favours bears". The Economic Times. Archived from the original on 7 August 2020. Retrieved 10 June 2020.

- ^ "Sensex crashes over 750 points to close at 38,720, Nifty ends at 11,559". WION. Archived from the original on 3 March 2020. Retrieved 3 March 2020.

- ^ "Sensex crashes by 624 points, Nifty settles at 10,925 as auto and telecom stocks drag". India Today. 13 August 2019. Archived from the original on 3 March 2020. Retrieved 3 March 2020.

- ^ a b "Markets end deep in red; Sensex falls nearly 590 points, Nifty slips below 10,750". Zee News. 22 August 2019. Archived from the original on 10 June 2020. Retrieved 10 June 2020.

- ^ Shah/Agencies, Palak (6 January 2020). "Sensex crashes 787 points as US-Iran tensions soar". Business Line. Archived from the original on 28 February 2020. Retrieved 28 February 2020.

- ^ BL Internet Desk (February 2020). "Sensex crashes 987 points to close below 40K mark; Nifty plummets 318 points". @businessline. Archived from the original on 2 February 2020. Retrieved 28 February 2020.

- ^ S. I. reporter (28 February 2020). "MARKET: Sensex tanks 1,448 pts on Coronavirus jitters, Nifty ends at 11,219". Business Standard. Retrieved 28 February 2020.

- ^ "LIVE News Updates: Sensex down by 893.99 points, currently at 37,576.62. Nifty at 10,989.45". National Herald. 6 March 2020. Archived from the original on 10 June 2024. Retrieved 6 March 2020.

- ^ "Sensex sinks 1,941.67 points to end at 35,635 amid coronavirus-led global market meltdown". Hindustan Times. 9 March 2020. Archived from the original on 10 June 2024. Retrieved 9 March 2020.

- ^ "Closing Bell: Sensex Crashes 2,919.26 Points To End at 32,778.14, Nifty Sinks 868.25 Points". News Nation. Archived from the original on 25 April 2020. Retrieved 12 March 2020.

- ^ "Panic selling continue on Dalal Street: Sensex sinks 2,713 points, Nifty settles below 9,200". timesnownews.com. 16 March 2020. Archived from the original on 10 June 2024. Retrieved 16 March 2020.

- ^ "Sell-off in banks, IT drags Nifty below 9K; Sensex see-saws 1,400 pts from day's high, ends at 36-month low". Moneycontrol. 17 March 2020. Archived from the original on 18 March 2020. Retrieved 17 March 2020.

- ^ "sensex today: Sensex tanks 1,710 points to close at 28,870; Nifty ends below 8,500". The Times of India. 18 March 2020. Archived from the original on 18 March 2020. Retrieved 18 March 2020.

- ^ "Sensex tanks over 1,700 points, Nifty at 37-month low; all sectors in red". Zee News. 19 March 2020. Archived from the original on 10 June 2020. Retrieved 10 June 2020.

- ^ "Sensex Ends 581 Points Lower, Nifty Dips Below 8300". NASDAQ. Archived from the original on 19 March 2020. Retrieved 19 March 2020.

- ^ "Investors become poorer by Rs 14.22 lakh crore in stock mark". The Times of India. 23 March 2020. Archived from the original on 23 March 2020. Retrieved 23 March 2020.

- ^ PTI (1 April 2020). "Sensex starts FY21 with 1,203-point plunge; bank, IT stocks hammered". The Hindu. ISSN 0971-751X. Archived from the original on 10 June 2024. Retrieved 15 September 2023.

- ^ "Sensex Down Over 700 Points, Nifty Struggles Below 8,100; Banks Bleed". NDTV.com. 3 April 2020. Archived from the original on 3 April 2020. Retrieved 3 April 2020.

- ^ "Sensex falls 535 points on weak global cues". The Hindu. 24 April 2020. Archived from the original on 25 April 2020. Retrieved 26 April 2020.

- ^ "Sensex crashes 2,002 points: Key factors behind stock market rout". The Economic Times. 4 May 2020. Archived from the original on 10 June 2024. Retrieved 4 May 2020.

- ^ "Stock Market Latest Updates: Sensex plummets 886 points, Nifty below 9,150-mark; Tech Mahindra, Infosys among top losers". Firstpost. 14 May 2020. Archived from the original on 10 June 2024. Retrieved 14 May 2020.

- ^ "Sensex slips 1,068 points, Nifty at 8,823 as economic stimulus fails to cheer Dalal street". businesstoday.in. 18 May 2020. Archived from the original on 24 May 2020. Retrieved 18 May 2020.

- ^ a b "Sensex tanks 709 points; Nifty closes below 10,000". Zee News. 11 June 2020. Archived from the original on 11 June 2020. Retrieved 11 June 2020.

- ^ a b Raj, Shubham (5 April 2021). "Sensex tumbles amid record jump in Covid cases: Key factors hurting Dalal Street". The Economic Times. Archived from the original on 5 April 2021. Retrieved 5 April 2021.

- ^ "It's raining memes online as Sensex crashes over 1,700 pts and investors lose more than Rs 8 lakh cr". Indian Express. 13 April 2021. Archived from the original on 12 April 2021. Retrieved 13 April 2021.

- ^ "Sensex falls 677.77 points, Nifty lowers to less than 17,700". Money Control. 31 October 2021. Archived from the original on 30 October 2021. Retrieved 1 November 2021.

- ^ "Sensex ends 2702 pts lower amid D-St Bloodbath, Nifty ends at 16247, Russia attacks Ukraine". The Financial Express. 24 February 2022. Archived from the original on 24 March 2022. Retrieved 16 March 2022.

- ^ Prashun Talukdar (19 May 2021). "Sensex Crashes 1,416 Points On Inflation Worries, Nifty Settles Below 15,850". NDTV. Archived from the original on 20 May 2022. Retrieved 20 May 2022.

- ^ "Stock Market Today Live Updates: Sensex closes 4000 pts lower after staging partial recovery, Nifty settles below 22,000 mark". The Indian Express. 4 June 2024. Archived from the original on 4 June 2024. Retrieved 4 June 2024.

- ^ Joshi, Armaan (6 August 2024). "Why Is The Market Falling Today? Sensex and Nifty Drop Explained". Forbes Advisor INDIA. Retrieved 6 August 2024.

- ^ Mishra, Lalatendu (5 August 2024). "Sensex slides 2.7% as global stock sell-off deepens". The Hindu. ISSN 0971-751X. Retrieved 6 August 2024.

- ^ "Sensex hits all-time high of 40,392, Nifty trading above 11,900: 10 things to know". BusinessToday. 31 October 2019. Archived from the original on 5 November 2019. Retrieved 24 November 2019.

- ^ "Sensex hits a new high, 4 factors that could be fuelling optimism". Moneycontrol.com. 20 November 2019. Archived from the original on 20 November 2019. Retrieved 24 November 2019.

- ^ "Sensex Climbs record high of 41,809; Nifty hits 12,293; Yes Bank, Hero MotoCorp stocks gain". ZeeBiz. 20 December 2019. Archived from the original on 22 December 2019. Retrieved 22 December 2019.